With 'everyone' on vacation, geopolitical chaos drove risk-off today

-

China trade war

-

Hong Kong revolt

-

PLA buildup

-

German recession

-

Italeave

-

Epstein farce

-

Argentina's ARS pounded

-

Kashmir chaos

-

Russian nuke explosion

-

Iran tanker safari

Sending gold above stocks for the year.

..Source: Bloomberg

And since Powell's "mid-cycle adjustment", gold and bonds are the big winner...

And on the day, investors dumped the broad market while piling into Bonds, Bullion, and BYND as safe-havens...

Source: Bloomberg

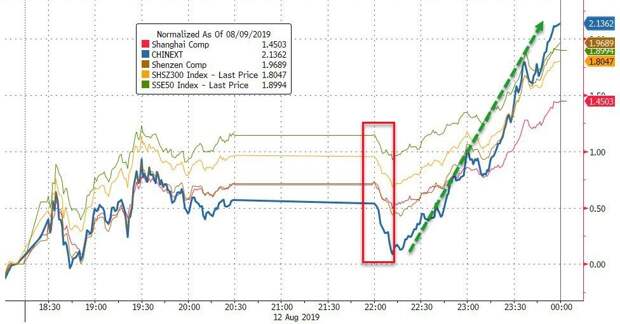

Chinese stocks were miraculously bid today (after some brief selling in the early afternoon session, stocks soared as HK tensions escalated)...

Source: Bloomberg

A positive open in Europe did not end well...

Source: Bloomberg

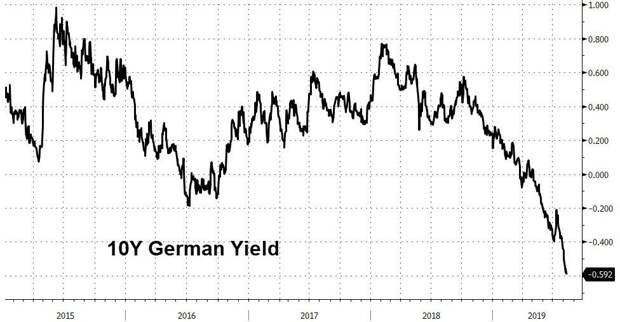

New record low close for Bund yields...

Source: Bloomberg

Crushing European Banks to a critical support level...

Source: Bloomberg

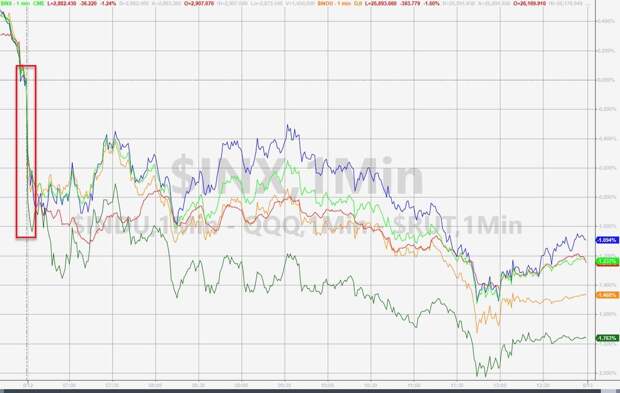

And US equities were all lower on the day (led by Trannies)...

CNBC Anchor: "Equity markets have picked up a bit, now down just 430 points"

Bagholder On CNBC: "...we don't want to sell, we are long term investors."

Seems like the Fib 61.8% retrace was the hard limit for the short-squeeze dead-cat-bounce...

All the major US equities broke back below key technical levels...

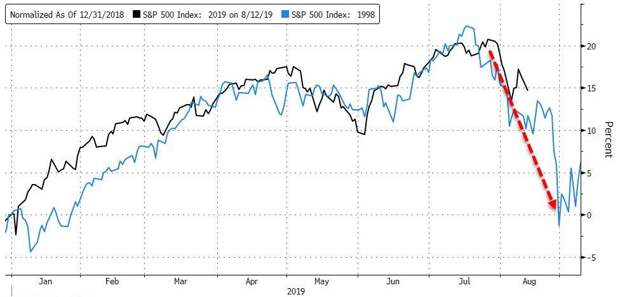

Eerily echoing 1998's performance...

Source: Bloomberg

VIX topped 21 intraday, and judging by 2s10s, has a long way to go...

Source: Bloomberg

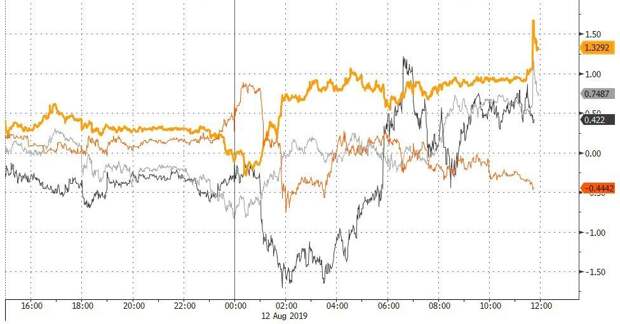

Stocks and bonds remain decoupled

Source: Bloomberg

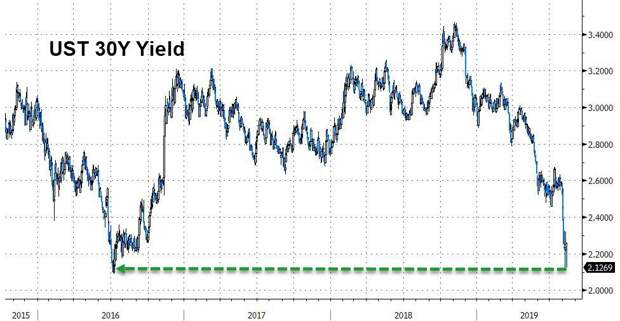

Treasury yields reverted back to collapsing today (led by the long-end)...

Source: Bloomberg

10Y Yields dropped to lowest since Sept 2016...

Source: Bloomberg

And 30Y is within a tick of record lows (2.09% on 7/8/16)...

Source: Bloomberg

The yield (2s10s) plunged to fresh cycle lows...

Source: Bloomberg

And 3m10Y is not at its most inverted since April 2007...

Source: Bloomberg

And in case you wondered how bad it could get, 5-year-forward 10Y yields plunged to a new record low...

Source: Bloomberg

Argentina was a bloodbath after Macri's dismal showing in the primaries...

The peso crashed 25%...

Source: Bloomberg

And bond prices collapsed...

Source: Bloomberg

Yuan slid modestly weaker (after 8th straight day of weaker fixes)

Source: Bloomberg

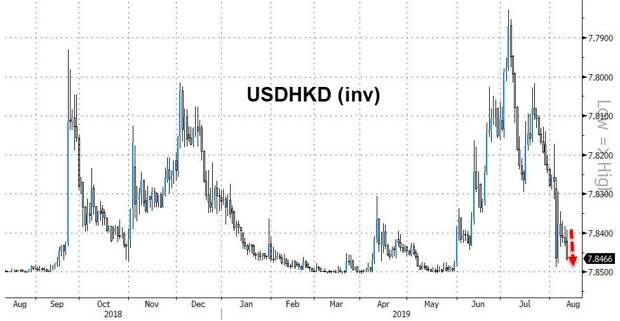

Hong Kong Dollar drifted back towards the low-end of the USDollar peg band...

Source: Bloomberg

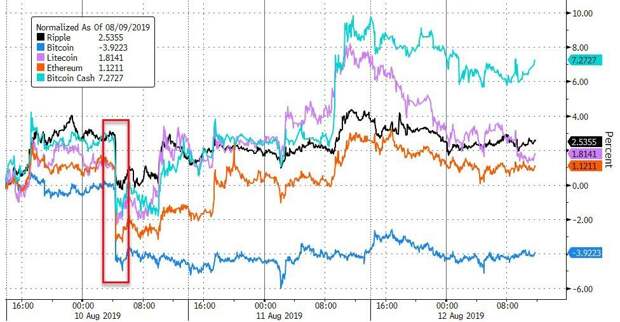

Cryptos are mixed since Friday after the overnight crash on Saturday morning (Bitcoin hovering around $11500)...

Source: Bloomberg

Copper was worst as crude managed to scramble back to breakeven but PMs were best...

Source: Bloomberg

As stock losses accelerated, gold (and silver) spiked higher...

With bund yields hitting new lows, gold will be pressured higher as having more yield than over $15 trillion of global bonds...

Source: Bloomberg

WTI bounced up to test $55...

Elsewhere in commodity-land, Iron Ore continues to crash...

-

DCE Iron Ore Spot index declines 9 days in a row.

-

Iron Ore futures -5.1%, low 609.5 RMB, 607 limit down

Source: Bloomberg

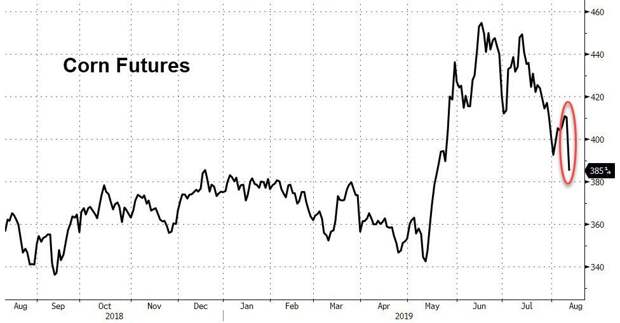

And Chicago Corn crashed most since 2013 as official corn-planting estimates exceeded analyst expectations.

Source: Bloomberg

Finally, as Gluskin-Sheff's David Rosenberg noted: "For all the excitement and jubilation as one high followed another, courtesy of stock buybacks for the most part, the reality is that the S&P 500 isn’t even 1% above where it was on January 26th, 2018. More than a year-and-a-half of nothing … except the dividend, that is."

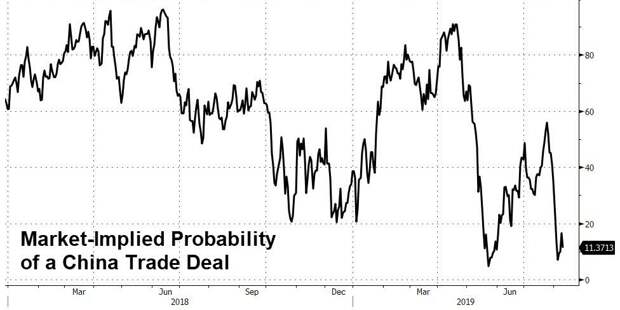

And for now, the market-implied odds of a trade deal saving the world are around 12%...

And so...

And...

Global Central Banks pic.twitter.com/2llHq9lLxn

— 🤬 (@FreefallCapital)