Despite an avalanche of hawknados (mixing metaphors in the most maleficent manner)...

-

*BULLARD SAYS MARKETS UNDERPRICING 'HIGHER FOR LONGER' RATES

-

*BULLARD SAYS GOOD CPI REPORT SHOULDN'T AFFECT SEPT.

FED CALL -

*WALLER BACKS 'ANOTHER SIGNIFICANT' RATE HIKE IN SEPTEMBER

-

*WALLER: INFLATION FAR TOO HIGH, PREMATURE TO JUDGE IT'S PEAKED

-

*WALLER: IF WE DON'T GET INFLATION DOWN WE'RE IN TROUBLE

-

*GEORGE: FED HAS SOME ROOM TO RUN TO BRING INTEREST RATES UP

-

*GEORGE: WARNS OF POSSIBLE DIFFICULT PATH IN LOWERING INFLATION

All of which sent hawkish waves through Short-Term Interest-Rates (STIRs)...

Source: Bloomberg

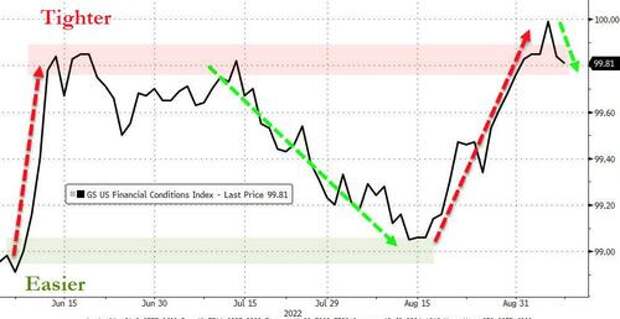

Powell leading his hawkmen into battle against the market short-squeeze-driven easing of financial conditions...

As far as rate-trajectory expectations, Sept is now almost a lock for 75bps, Nov is pricing in a 50bps hike (16% odds of another 75bps), and Dec is priced for a 25bps hike...

Source: Bloomberg

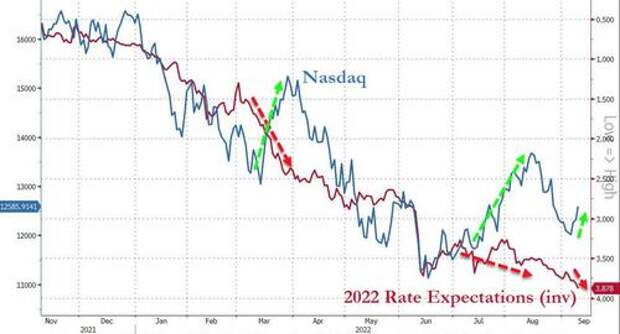

US equity markets rallied on the week in the face of surging rate expectations... (it's happening again)...

Source: Bloomberg

The narrative delivered to investors is 'hope' for a 'soft landing' and 'peak inflation' - which is echoed by the collapse in Breakevens - but STIRs ain't buying it and this has the smell of another June-July-esque negative-delta squeeze as the last 3 days have seen 'most shorted' stocks soar over 12% - the biggest 3-day squeeze since late-May. ..

Source: Bloomberg

Nasdaq and Small Caps led the charge on the week, erasing all of the post-payrolls pump'n'dump...This is the best week for the S&P 500 since early July...

All the US majors pushed back up to (and beyond in some cases) their 50- and 100-DMAs...

The S&P 500 squeezed back above 4,000 and traded back into the range of Jay Powell's Jackson-Hole speech day)...

Consumer Discretionary sector outperformed on the week and whil Energy soared today, it was the laggard on the week (though all sectors were green on the week)...

Source: Bloomberg

The holiday-shortened week saw Treasury yields higher across the curve with the short-end underperforming...

Source: Bloomberg

2Y Yields topped 3.56% - the highest since 2007...

Source: Bloomberg

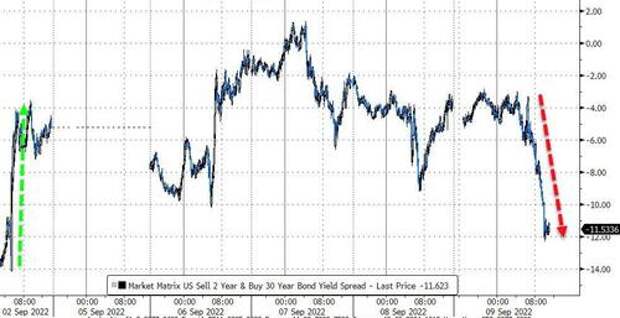

The yield curve flattened/inverted further this week, reversing all of the post-payrolls print steepening...

Source: Bloomberg

Breakevens (especially shorter-dated) have plunged this week - now 2Y BEs at their lowest since Jan 2021...

Source: Bloomberg

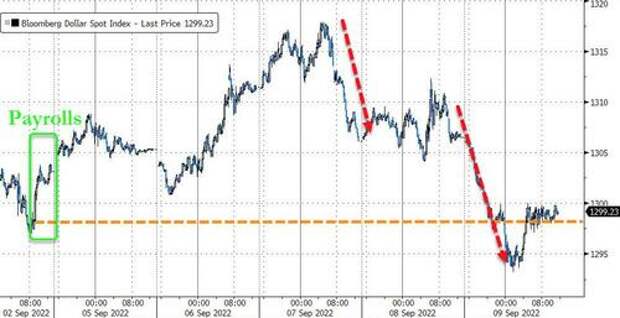

The dollar slipped lower on the week (after an initial surge) ending back unchanged from before the payrolls print last week...

Source: Bloomberg

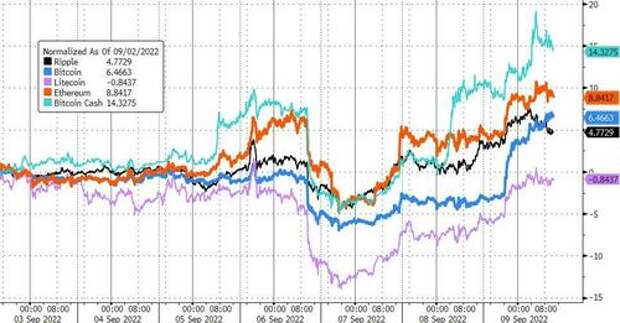

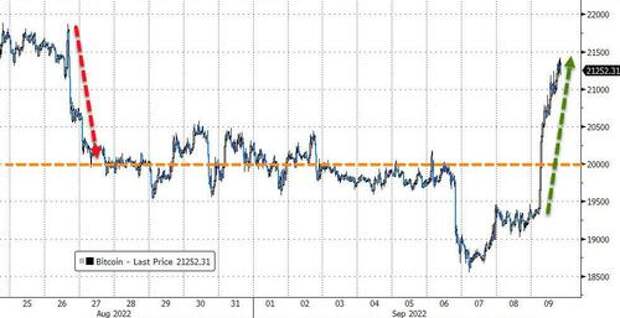

Cryptos managed gains on the week with Ethereum outperforming bitcoin...

Source: Bloomberg

As Bitcoin surged up towards $21,500 today, erasing most of the post-Powell-Jackson-Hole plunge...

Source: Bloomberg

Commodities were oddly mixed this week with Silver and Copper soaring while gold and crude ended unchanged...

Source: Bloomberg

Gold managed to find support at $1700 once again this week...

Source: Bloomberg

Finally, we note that financial conditions have 'eased' back from mid-June highs (tights) in the last few days...

Source: Bloomberg

Will this 'easing' cycle swing all the way lower again?

Jay Powell is not going to be happy...