There was a curious observation in this morning's note from the BofA trading desk: the bank's traders pointed out something we first brought

So what's going on here? For the answer we go to the latest note from VandaTrack, which suggests that our skepticism about retail participation may be misplaced. As a reminder, two weeks ago we speculated that retail investors are losing their interest in markets when we quoted from a JPM analyst report which said that the "retail buying impulse showed signs of slowing before this latest burst of selling. After adjusting for inverse ETFs, not only is the May MTD net flow negative for the first time since Mar-2020, but also the monthly inflow in April was smallest since Sep-2020."

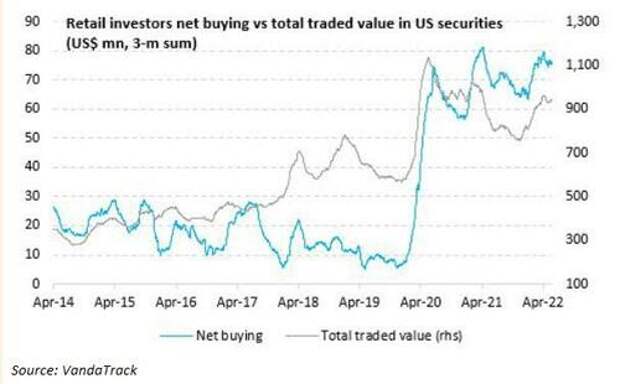

It appears that JPM was wrong, because according to the more accurate retail flow analytics by Vanda Research, the net aggregate retail purchases of US securities by retail investors remains strong, hovering near the historical all-time-highs of Jan ’21.

In fact, net inflows into US equities sit at US$ 76BN on a 3-month basis (US$ 1.3 bn/day on average). Whilst the total traded value is somewhat lower compared to that of the Covid sell-off, it is still significantly higher than any pre-Covid period (at US$ 936 bn on a 3-month basis, US$ 15bn/day on average.

Another remarkable observations from Vanda: The post-Covid class of retail investors - those who received much of their trading education on reddit - is a much tougher opponent than in the past. Here's why: whereas retail investors’ performance has never been worse since the start of Vanda's data in 2014 - with the average portfolio drawdown just surpassing the Covid sell-off - currently at -32% - this time around they refuse to throw in the towel. As Vanda adds, "when facing losses of this magnitude retail would have traditionally given the first signs of capitulation," but this time "sentiment appears to be (still) quite resilient." To be sure, Vanda expects risk-aversion to eventually return – more so if equities experienced a sharp and quick drawdown from here.

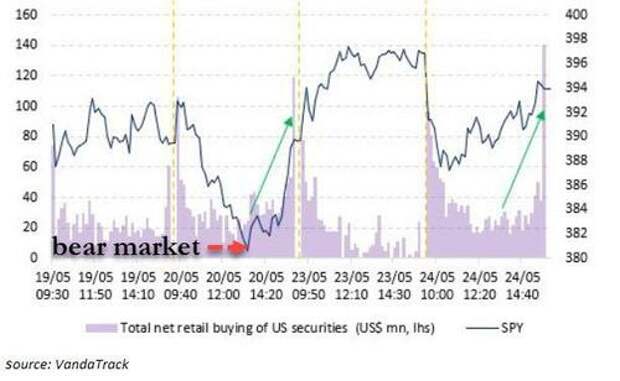

Even more remarkable is that contrary to speculation that late-day hedge fund buying is behind the illiquid market's furious last hour ramp, Vanda concludes that "retail investors seem to be behind the quick late afternoon recoveries in the S&P 500 in the last few days." In fact, Vanda suspects that institutional asset managers were the cohort of investors reducing equity allocations in the morning last Friday and Monday, while retail investors aggressively bought the dip towards the end of the trading session. This also means that one can thank retail investors for the miraculous ramp last Friday which pulled stock out of what was a certain -20% bear market from all time highs.

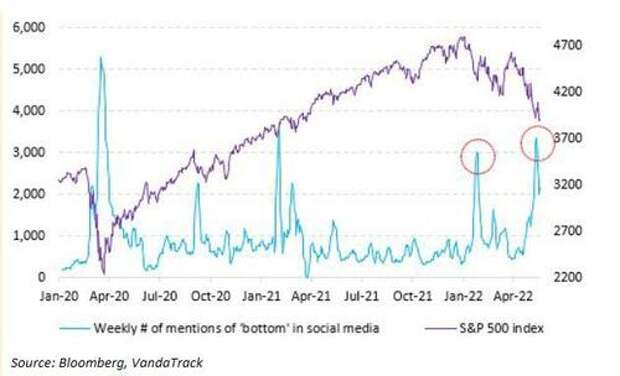

Alternative sentiment indicators from social media appear to confirm that retail investors are still focused on buying the dip. As Vanda notes, the number of comments and threads related to “market bottom” in the WSB subreddit has increased to the same highs as of last January, suggesting that speculative retail investors are once again seeing signs of a market bottom at the current levels (that said, levels are much lower than in Mar ’20 – the true market bottom of the cycle).

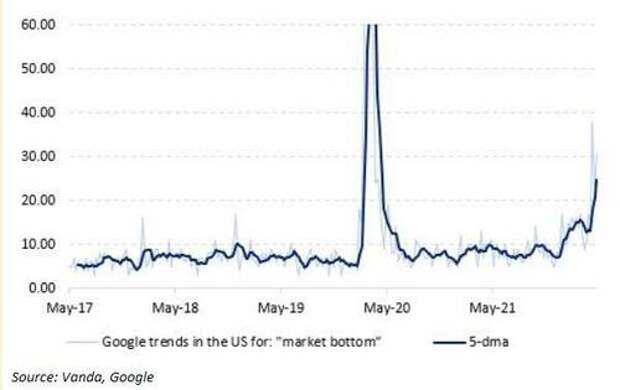

Indeed, google trends data confirms that interest regarding the “market bottom” remains far from levels reached during the Covid drawdown. Although the number of searches related to the topic is far from the levels seen in early 2020, the popularity of these terms (“market bottom”) is three times higher than during the Q4 2018 sell-off. However, one troubling way to frame this data is to look at it in a probabilistic way, doing so would indicate that retail sentiment only prices in a ~30% probability that we have seen a market bottom. Some food for thought.

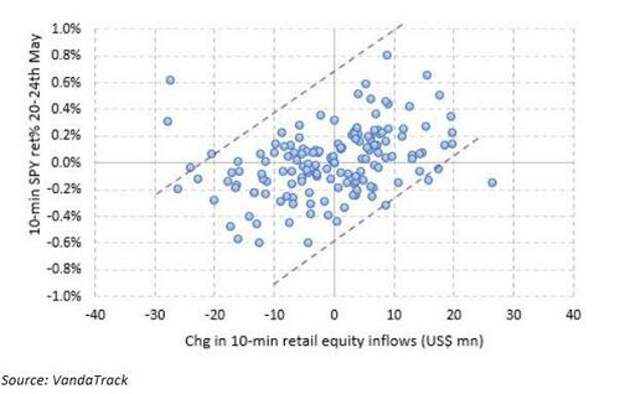

So how much retail buying is sufficient to send the market into a late-day overdrive? According to Vanda, net retail buying data show high correlation with the intraday price movements in the S&P 500. A change in net retail buying worth US$ 10 million moved equities by roughly 20 bps, on average - at least in the last 3 trading days.

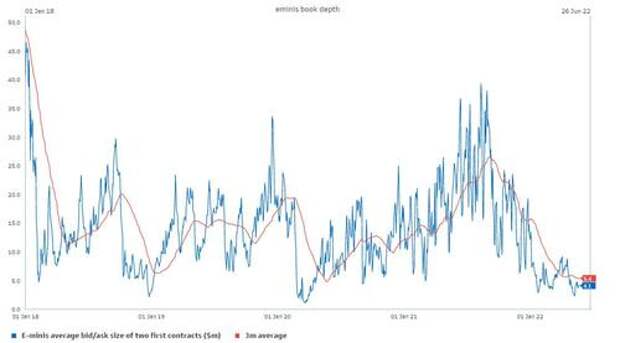

Yes it takes just $10 million or so to set a tactical bottom, which makes sense in a market as illiquid as this one, where as we have repeatedly shown, Emini liquidity is at all time lows and it takes just a few million to move the index on tick...

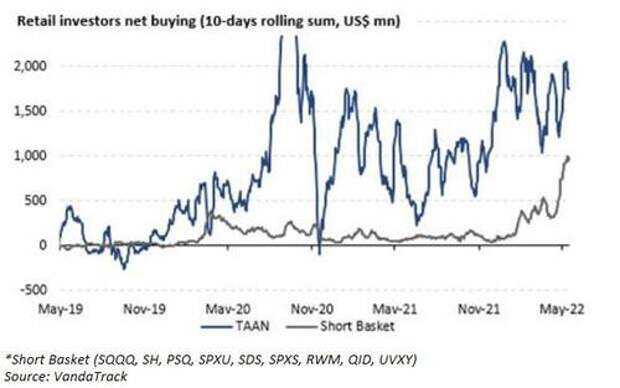

... which is why retail has once again emerged as the marginal price setter... and bear-market avoider for the Biden administration, although as the final Vanda chart shows, at least someone among the retail community is performing well as unlike last year, purchases of inverse ETFs continue to make new records and have now grown enough (~10x) to rival the TAAN’s (Tesla, AMD, Apple and NVDA) usually dominant flow. Yes: retail has discovered a barbell strategy of buying the ultrahigh beta stocks, while hedging against a broader market crash (retail protection via put options has seen volumes increase meaningfully so far this year according to Vanda, at the same time, the continued rise of alternative protection proxies (such as inverse ETFs) confirms an increasing degree of retail scepticism towards the odds of a rebound from here).

And so while retail has so far successfully defended the S&P from a full-blown bear market on no less than three occasions, can it keep doing so (and will it, as it increasingly hedges for a crash) for the foreseeable future, especially if inflation keeps stealing what little is left of US consumer disposable income...