Those looking for signs of a panic stampede into stocks among retail investors - and apparently institutional one too now that they have capitulated on sitting on the fence and are rushing into risk assets - look no further than the following three charts.

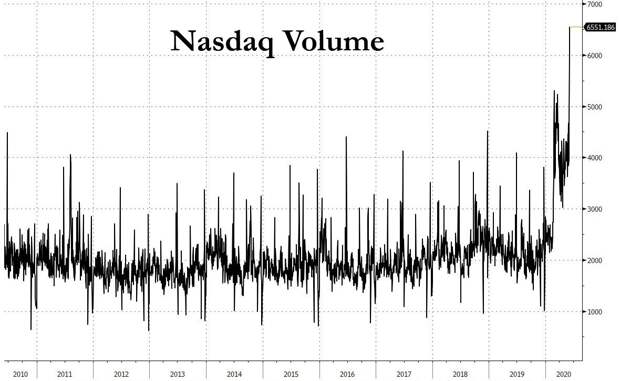

Whether due to expectations of even more upside, or just in hopes of catching some more herd-driven momentum, on the day the Nasdaq Composite hit a new record intraday high, the volume in the Nasdaq also hit an all time high, a clear indication of the frenzy that has gripped tech names.

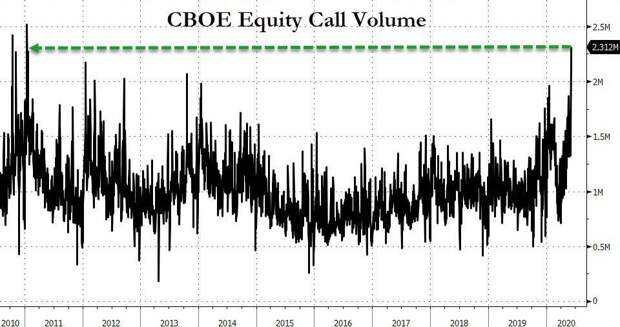

And since in a market backstopped by the Fed plain-vanilla, unlevered returns are for amateurs, today also saw a near record burst in overall call volumes as investors not only bought stocks but did so with generous helpings of leverage.

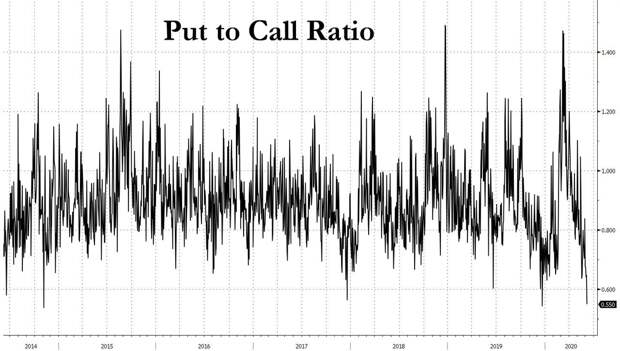

Finally, since this is "Jay's market" after all, and it is Jay's job to insure that nobody loses money ever again, there is no point in hedging, and sure enough the Put to Call ratio tumbled to just shy of all time lows as the VIX will soon start rising not due to put prices but calls.