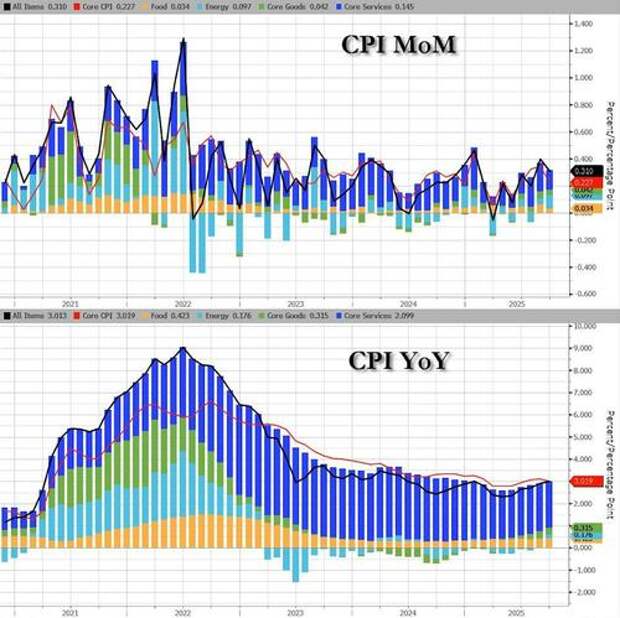

With vol markets fully clenched, this morning's much-anticipated CPI print (no matter how full of guesstimated data) is sure to prompt an initial flurry of trading activity but as we detailed in our preview, absent some major outlier, is likely to be mostly irrelevant with rate-cut expectations now fully pricing in 2 x 25bps cuts for the rest of the year.

As a reminder, this data was supposed to originally be revealed on Oct 15 and would have been indefinitely delayed had the White House not intervened with a demand that the BLS recall staff and figure out what the number is and report it today at 8:30amET.

Just as we suggested, the headline data was a miss (cooler than expected)...

CPI Preview: Likely A Miss But Mostly Irrelevant https://t.co/hEwPttKmOG

— zerohedge (@zerohedge)

...rising 0.3% Mom (vs +0.4% exp), with the YoY print at 3.0% (below expectations of +3.1% but higher than the 2.9% YoY print in August).

Source: Bloomberg

That is the hottest YoY headline CPI since January.

Energy costs rose but Services slowed...

Source: Bloomberg

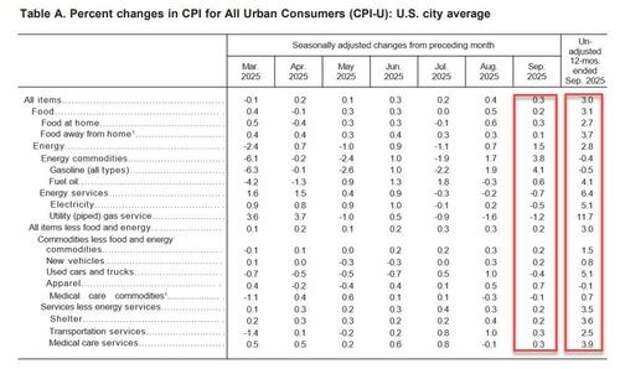

Headline CPI highlights:

-

The index for gasoline rose 4.1% in September and was the largest factor in the all items monthly increase, as the index for energy rose 1.5% over the month.

-

The gasoline index increased 4.

1 percent over the month. -

The index for electricity decreased 0.5 percent over the month and the index for natural gas decreased 1.2 percent over the same period.

-

-

The food index increased 0.2% over the month as the food at home index rose 0.3% and the food away from home index increased 0.1%

-

Four of the six major grocery store food group indexes increased in September.

-

The index for other food at home rose 0.5 percent over the month after rising 0.1 percent in August.

-

The cereals and bakery products index and the nonalcoholic beverages index both increased 0.7 percent in September

-

The dairy and related products index declined 0.5 percent in September as the cheese and related products index decreased 0.7 percent. The index for fruits and vegetables was unchanged over the month

-

The index for limited service meals rose 0.2 percent over the month while the index for full service meals was unchanged

-

-

Other indexes with notable increases over the last year include medical care (+3.3%), household furnishings and operations (+4.1%), recreation (+3.0%), and used cars and trucks (+5.1%).

Energy Services costs and Used Car prices fell MoM (along with electricity costs - which is odd given the massive increase in demand via AI Data Center build outs) but Gasoline costs rose notably...

...something that will be erased next month as oil prices tumbled...

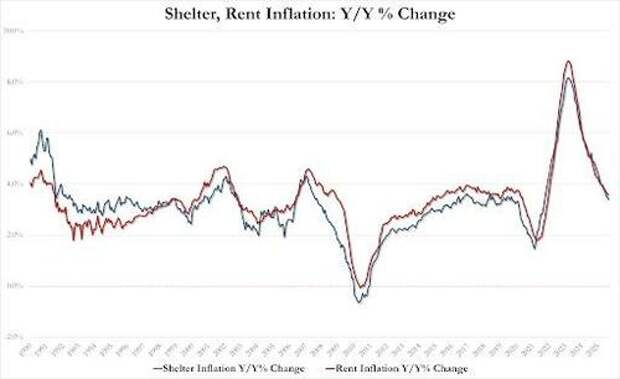

On an annual basis, the shelter index increased 3.6% over the last year (but continues to slow dramatically).

-

Rent inflation rose 3.40% YoY in Sept, down from 3.49% in Aug and the lowest YoY increase since Dec. 2021; it was also up 0.17% MoM, the smallest monthly increase since August 2021

-

Shelter inflation rose 3.58% in Sept, down from 3.63% in Aug and the lowest annual increase since Oct 2021; it was also up 0.28% MoM, down from 0.34% in Aug.

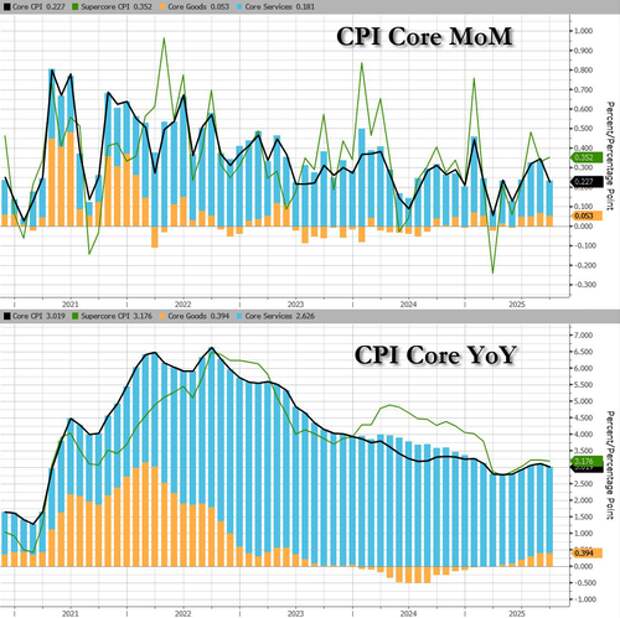

A similar pattern was seen in Core CPI data with the print rising 0.2% MoM (below expectations of +0.3%), but pulled the YoY print down to 3.0% (down from 3.1% in August), the lowest since June...

Source: Bloomberg

Core CPI highlights:

-

Indexes that increased over the month include shelter, airline fares, recreation, household furnishings and operations, and apparel

-

The indexes for motor vehicle insurance, used cars and trucks, and communication were among the few major indexes that decreased in September.

Core CPI details:

-

The shelter index increased 0.2 percent over the month.

-

The index for owners’ equivalent rent rose 0.1 percent in September, the smallest 1-month increase in that index since January 2021.

-

The rent index increased 0.2 percent over the month.

-

The index for lodging away from home rose 1.3 percent in September.

-

-

The index for airline fares increased 2.7 percent over the month, after rising 5.9 percent in August.

-

The recreation index rose 0.4 percent in September as did the household furnishings and operations index.

-

The index for apparel rose 0.7 percent over the month and the index for personal care increased 0.4 percent.

-

The new vehicles index rose 0.2 percent in September.

-

The index for used cars and trucks also decreased 0.4 percent over the month and the index for communication declined 0.2 percent.

-

The motor vehicle insurance index declined 0.4 percent in September, after being unchanged in August.

-

The medical care index increased 0.2 percent over the month, after declining 0.2 percent in August.

-

The index for hospital services increased 0.3 percent over the month, as did the index for prescription drugs.

-

The dental services index decreased 0.6 percent in September and the physicians’ services index declined 0.1 percent.

Core Services costs declined significantly...

Source: Bloomberg

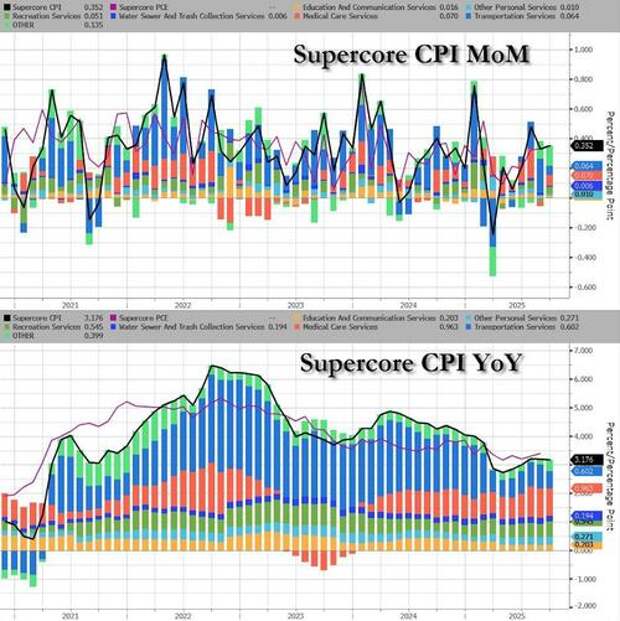

Finally, SuperCore CPI (Services Ex-Shelter) also saw its YoY print slow to +3.30% (the slowest since May)...

Source: Bloomberg

Transportation Costs slowed dramatically in September...

Source: Bloomberg

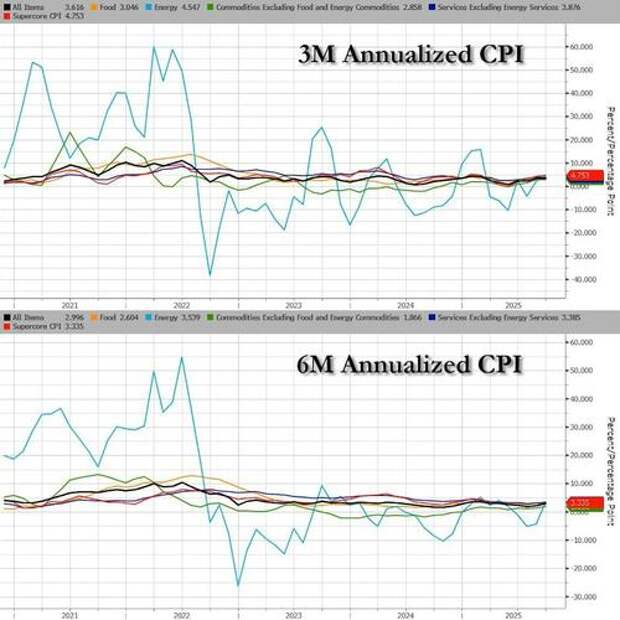

On a 3m and 6m annualized basis there is no sign of the hyped-up tariff-driven inflation that the left and their establishment puppets have been screaming about for months...

Source: Bloomberg

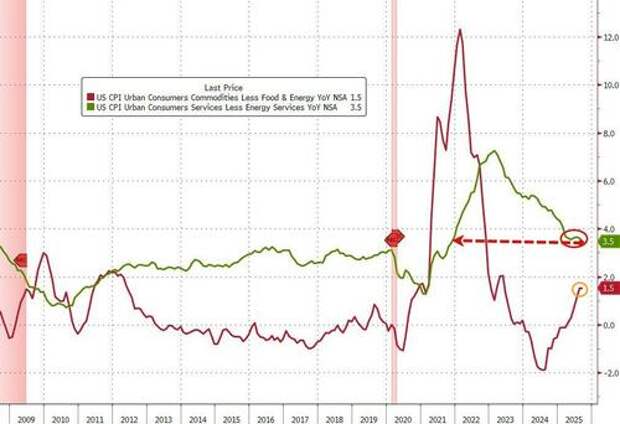

Summing up September's (delayed) data, Services inflation slowed to its weakest since Nov 2021 and Goods inflation was flat at +1.5% YoY...

Source: Bloomberg

There's certainly nothing here to stop The Fed cutting rates again next week.

But we do note that given the surge in money supply, once could argue, re-inflation is coming...

By which time Trump will have a new Fed head to bully.

Свежие комментарии