Chicago soybean futures rose to a four-year high on Thursday morning, as dry weather in South America and increasing demand from China supported prices.

"China is actively buying beans and we are seeing additional demand emerge from Brazil," a Singapore-based commodity trader said, who was quoted by Reuters.

The trader continued: "The weather is not perfect for Brazil and the crop is likely to get delayed due to the dry weather.

"November soybean contracts trading on the Chicago Board of Trade were up more than 1% Thursday morning, trading around $10.95 per bushel, climbing to the highest level since July 2016.

Reuters notes La Nina weather pattern remains a risk for crops across South America. Their commodity desk said Brazil's soybean-growing areas recorded rain this week, but other surrounding areas need moisture.

Commodity traders will be closely watching the USDA Nov. 10 supply/demand reports, which some experts believe it could show "scaled-back U.S. soybean yields and increased export forecasts," said Reuters.

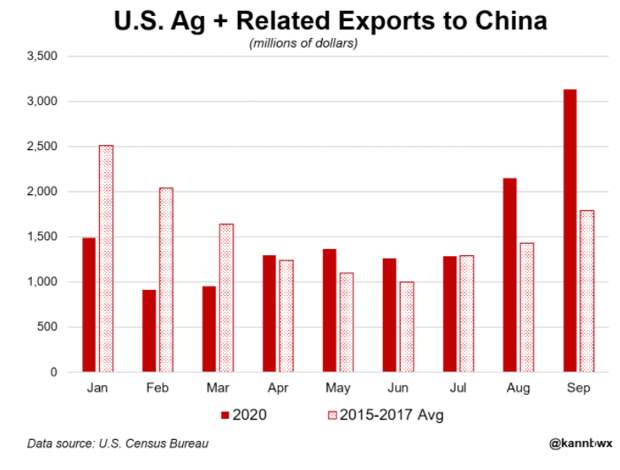

Reuters' Karen Braun said, "China's strong return to the U.S. soybean market in recent months has single-handedly lifted U.S. farm exports to the Asian country to new records, and the heavy forward shipping schedule bodes well for the promises outlined in the Phase 1 trade agreement between the two countries."

Even though China's demand for U.S. farm goods has increased late in the year - it's likely trade commitments outlined in the Phase 1 agreement won't be met this year.

China is way behind in farm good purchases.

Could soybean prices also be soaring because the prospects of a Biden presidency would be mean friendlier relations with China?