QE4 has officially arrived.

As previewed yesterday, moments ago the Fed concluded the first POMO - as in Permanent Open Market Operation, not to be confused with Temporary - from previously announced T-Bill purchases ($60 billion per month, $7.

5 billion per operation), and what it showed is a confirmation of message sent by today's repo operation: there is an unprecedented demand for liquidity.Specifically, the Fed purchase $7.501 billion in Treasury Bills out of $32.569 billion in T-Bills submitted. In other words, the operation was 4.3x oversubscribed, and when combined with the oversubscribed repo operation announced earlier today, confirms that there is a dramatic need for liquidity among the Primary Dealer community.

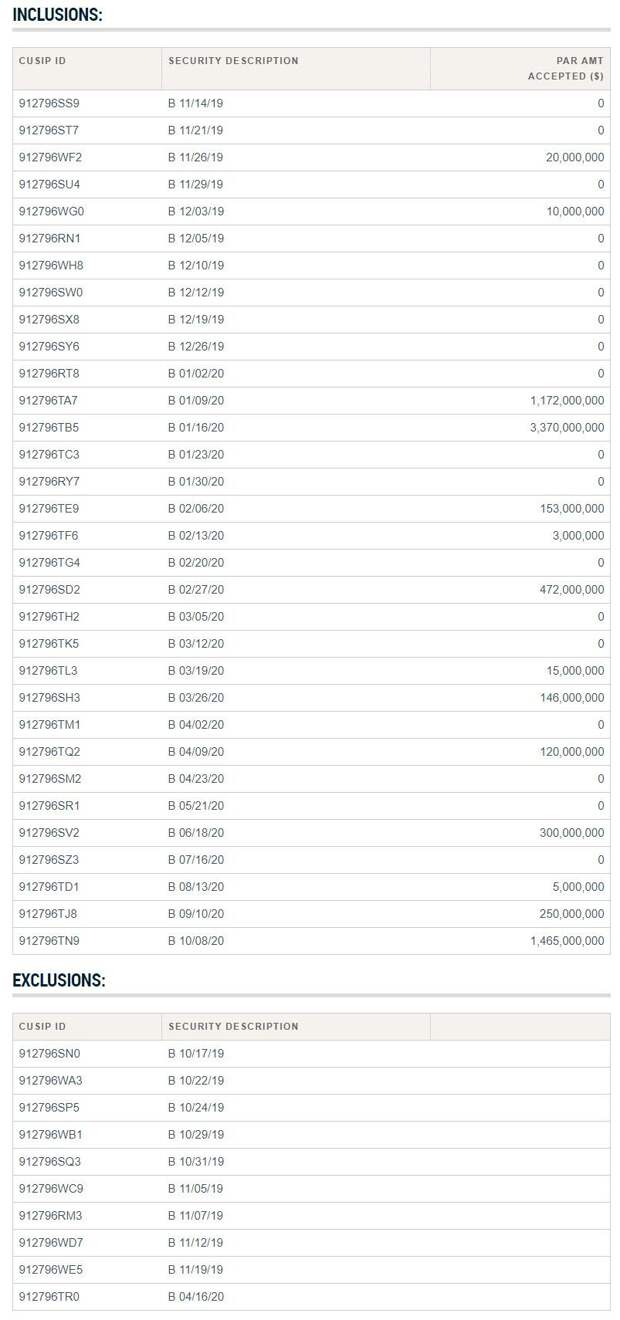

Separately, as previewed yesterday, the Fed did not purchase securities with less than 4 weeks to maturity or cash management bills, and sure enough, the "nearest" maturity purchased today was Bills maturing on Nov 26, for some $20 million. The most aggressive purchases were for CUSIPs TB5 and TN9, for the amount $3.37BN and $1.465BN, respectively, and which mature on Jan 16, 2020 and Oct 8, 2020. The sub-1 month Bills were all excluded from today's operation.

And with that, QE 4, pardon, "Not A QE" has begun, and will continue "at least into the second quarter" of 2020, by which point the Fed will have purchased over $300 billion in Bills, and will at some point find itself compelled to shift to buying short-maturity coupons as well as the "Not A QE" gradually morphs into a full-blown QE.

Свежие комментарии