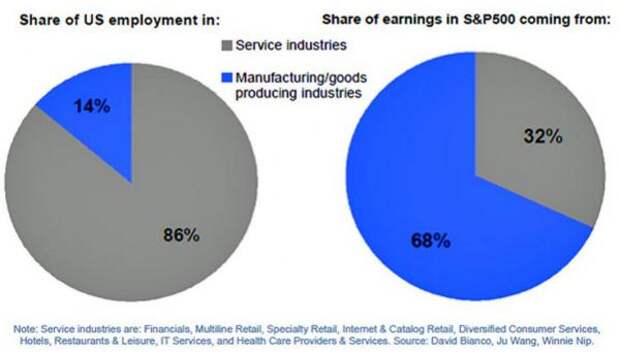

Despite the services economy starting to turn down towards manufacturing's inevitable recessionary prints, there remains a hope-strewn crowd of status-quo face-savers desperately clinging to the linear-thinking "but manufacturing is only 12% of economic output and thus is no longer a good bellwether for the overall economy" narrative. Here is why they are wrong not to worry...

On the left below, we see the mainstream media's perspective on why a collapse in manufacturing "doesn't matter" and you should buy moar stocks.

On the right below, we see why it does... especially since the "doesn't matter" narrative is used only to justify buying moar stocks.

..h/t @Spruce_gum

Which explains why this is happening!!

Self-destructing The Fed's very own wealth-creation scheme.

While it is hoped that the economy can continue to expand on the back of the "service" sector alone, history suggests that "manufacturing" continues to play a much more important dynamic that it is given credit for.

The decline in imports, surging inventories, and weak durable goods all suggest the economy is weaker than headlines, or the financial markets, currently suggest. And in fact, services are starting to follow...

Of course, as we previously concluded, while recessions are "needed," public opinion is generally quite simple in regard to recession: upswings are generally welcomed, recessions are to be avoided. The “Austrians” are however at odds with this general consensus — we regard recessions as healthy and necessary. Economic downturns only correct the aberrations and excesses of a boom. The benefits of recessions include:

- Sclerotic structures in the labor market are broken up and labor costs decline.

- Productivity and competitiveness increase.

- Misallocations are corrected and unprofitable investments abandoned, written off, or liquidated.

- Government mismanagement of the economy is exposed.

- Investors and entrepreneurs who were taking too great risks suffer losses and prices adjust to reflect consumer preferences.

- Recessions also allow a restructuring of production processes.

At the end of the corrective process, the foundation for a renewed upswing is more stable and healthy. We thus see deflationary corrections as a precondition for growth in prosperity that is sustainable in the long term. Ludwig von Mises understood this when he observed:

The return to monetary stability does not generate a crisis. It only brings to light the malinvestments and other mistakes that were made under the hallucination of the illusory prosperity created by the easy money.

However, in addition to leading to true temporary hardship for the malinvestment-affected areas of the economy, an economic recession in the near future would represent a harsh loss of face for central bankers. Their controversial monetary policy measures were justified as an appropriate means to nurse the economy back to health. That is, their efforts to end or avoid helpful recessions were claimed to contribute to the eagerly awaited self-sustaining recovery.