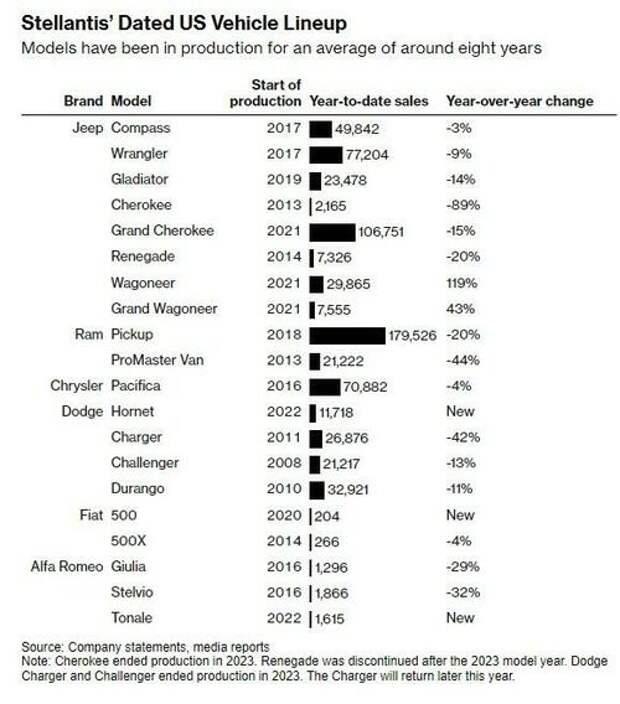

All of a sudden, Stellantis is having trouble selling Jeeps. And it comes at a time when SUV demand has never been greater.

Stellantis' Ram pickup division has also slipped in sales rankings, and Chrysler now only produces minivans.

This decline resulted in poor earnings and a 40% stock drop from March highs recently. Seven senior executives have also departed since January.CEO Carlos Tavares, who recently secured a massive €36.5 million compensation package, has faced rapid setbacks. His strategy to protect profit margins led to higher prices for outdated products compared to competitors, resulting in lost market share and increased inventory, Bloomberg reported this week.

Pierre-Olivier Essig, a London-based equities analyst at AIR Capital told Bloomberg: “The descent is starting and Tavares has his back against the wall. The cost cutting is exhausted and there isn’t enough innovation.”

The company is pulling out all of the stops to try and move metal, the report says. It reduced prices for the Jeep Compass and Grand Cherokee SUVs and added more features to adjust to higher interest rates. Despite this, Jeep’s US sales dropped 19% in the second quarter, the report said.

However, Jeep will soon introduce two new electric models: the Wrangler-like Recon and the 600-horsepower Wagoneer S. But these introductions come at a time when interest in electric is starting to wane.

On the other hand, Jeep also plans to reintroduce the Cherokee, which ceased production last year, affecting its competitiveness in the SUV market's largest segment.

Meanwhile, Ford has benefited from Stellantis’ struggles, selling over 400,000 SUVs in the first half, a record for the company.From 2019 to spring 2024, Stellantis increased prices for Jeep by about 50% and Ram by 40%, compared to the industry average of 25%, driven partly by post-pandemic supply chain issues, according to Cox data.

Erin Keating, an executive analyst at market researcher Cox Automotive told Bloomberg: “Product mix and pricing are the two big challenges they have.”

Like Jeep, Ram saw a significant decline in the first half, with US sales of its pickups dropping 20% from the previous year. Ford’s F-Series also experienced an 8% decline, while GM boosted sales of the Chevy Silverado and GMC Sierra.

And Stellantis has faced significant executive turnover in North America. Mark Stewart, the COO, left in January to become CEO of Goodyear Tire & Rubber Co. Long-time Jeep and Ram executives Timothy Kuniskis and Jim Morrison retired within weeks of each other, and Jason Stoicevich resigned after two months as senior VP of US retail sales.

CEO Tavares told Bloomberg: “The transition that we are going through is immensely challenging. This is a bump. There will be other bumps. This will last for a few years — this is not a short-term turmoil — and the most resilient, the most focused, the most customer-focused, will survive.”