By Garfield Reynolds, Bloomberg Markets Live reporter and strategist

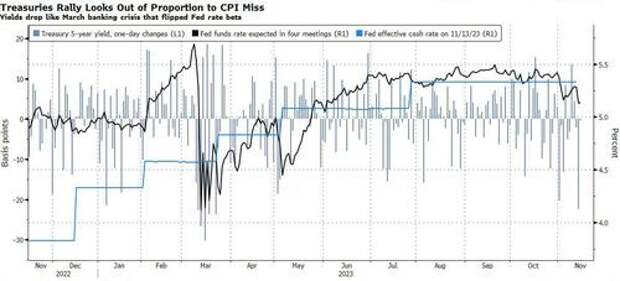

The Treasuries rally that followed a modest miss on inflation data looks too good to be a true reflection of where the economy is heading. As traders focused on the shorter end of the curve, five-year yields dropped the most since March, when a banking crisis raised concerns that the US could rapidly tip into a recession.

Considering that core annual inflation came in at 4.0%, rather than holding at 4.1% as expected, Tuesday’s move looks excessive.A consideration of what went on in the rates market underscores that perception. Traders erased the small remaining bets on hikes, while the fourth-meeting dated OIS — which currently covers the May 2024 meeting — went from pricing in about 20% odds of a cut to signaling an 80% chance. That seems impressive but it’s a far cry from March, when the fourth-meeting OIS flipped from pricing in at least four hikes to signaling two rate reductions.

The likelihood is that a rush to cover shorts and put on fresh longs overcharged the rally as investors hurried to anticipate a rapid Fed pivot toward rate cuts. That’s despite policymakers saying after the CPI data they still see a long, potentially hard road to get inflation back down where they want it.