Authored by Simon White, Bloomberg macro strategist,

The troubles facing Credit Suisse are enough to give the ECB cover to hike 25 instead of 50 bps at its meeting tomorrow, or not at all if CS’s situation becomes critical.

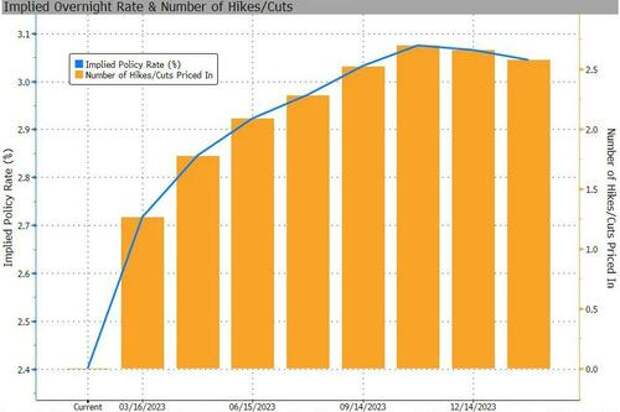

But persistent inflation will mean there remains a likelihood of subsequent ECB hikes, which would resteepen the front part of the Euribor curve after its dramatic flattening today.

The optimism on Europe over the last few months was based largely on sentiment and survey data. The problem with recoveries dependent on such “soft” data is that they can evaporate quickly.

The concern around Credit Suisse, after SVB’s failure, is enough to decimate any good feeling around the European economy, where the hard data -- money growth and retail sales, for example -- is consistent with a recession. Last week’s call that European banks’ stellar outperformance might be coming to an end was fortuitous in its timing.

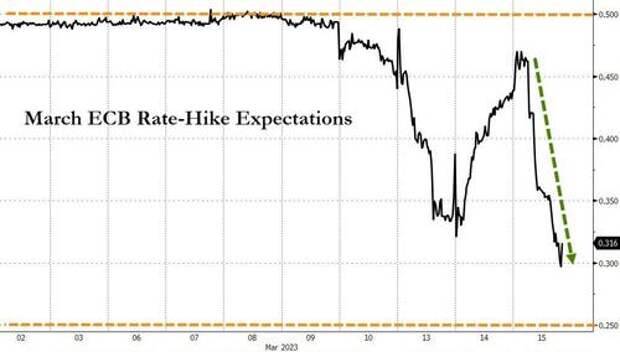

All this leaves the ECB in a bind at tomorrow’s rate-setting meeting. A 44-bp rise was priced in on Monday, that has fallen to ~29 bps this morning. The market volatility and worries around financial stability would give the ECB room to hike only 25 bps tomorrow. That would allow policymakers to send the message they are still focused on inflation, while buying them wriggle-room if sentiment sours further still.

The front part of the Euribor curve (e.g. ERM3 versus EMU3 or ERZ3) has flattened back to close to 0. But inflation is not going away -- and also ultimately poses risks to economic and financial stability -- which means there is the likelihood of hikes being priced back in at subsequent meetings.

ERM3/U3 and ERM3/Z3 therefore look like they are poised to re-steepen, once the initial panic moves are out of the way.