You won't find Roaring Kitty Capital, LP in any Goldman Sachs salestrader's rolodex but to the millions of WallStreetBets daytrading fanatics, the name Roaring Kitty is far more popular than Bridgewater, Citadel, or Millennium.

And for good reason: Keith Gill, the person behind the moniker "Roaring Kitty" and "DeepFuckingValue", who launched a historic short squeeze across multiple asset classes in January, destroying Melvin Capital (which needed a bailout from both Ken Griffin and Steve Cohen) and several other heavily bearish hedge funds, showed ordinary investors that virtually anyone can become a millionaire with lots of hard work and preparation... before eventually ending up in Congress explaining to Maxine Waters just how a relative nobody managed to outsmart people who run billions thanks to his now iconic investment in Gamestop.

Another reason why "Roaring Kitty" has earned the respect of his peers is that unlike so many traders who make a buck on a trade and move on, Gill has demonstrated true diamond hands, and not only that but he is now literally doubling down on the company that brought him stardom and riches by exercising his call options and buying even more shares.

"DeepFuckingValue" posted a screenshot of his portfolio showing that he has exercised 500 GameStop call options expiring Friday at a strike price of $12, giving him 50,000 more shares of a stock that closed at $154.69 on Friday, but will likely blast off on Monday once the Reddit animal spirits are reignited.

There's more: in addition to exercising his options, Gill also bought another 50,000 shares of the video-game retailer, doubling his holdings to 200,000 shares from 100,000 at the beginning of the month. His total investment in GameStop is now worth more than $30 million, giving him a profit of nearly $20 million. Bloomberg reached out to Gill’s mother, Elaine Gill at his childhood home in Massachusetts, who confirmed the Reddit screenshots were posted by her son.

Despite having earned the praise and admiration of most of his peers for executing what many have said has been the most astute short squeeze since Volkswagen, there were haters too and roughly around the time Gill was explaining to Maxine Waters how investing works, he was hit with a lawsuit that accused him of misrepresenting himself as an amateur investor. The suit alleged that he was actually a licensed securities professional who manipulated the market for profit, which he denied.

To be sure, it wasn't just Gill: some argue that the true mastermind behind the Gamestop squeeze was not Roaring Kitty at all but hedge fund Senvest which started buying GME shares all the way back in September - roughly around the time the post "The REAL Greatest Short Burn of the Century" appeared on Reddit and which made over $700 million on its GME position which has given it the top position in the HSBC hedge fund ranking for the third month in a row

Meanwhile, on Friday GameStop CEO George Sherman who is expected to leave, sold almost $12 million in shares. The company is looking for a new CEO as part of a shake-up spurred by activist investor and Chewy.com co-founder Ryan Cohen, Bloomberg notes.

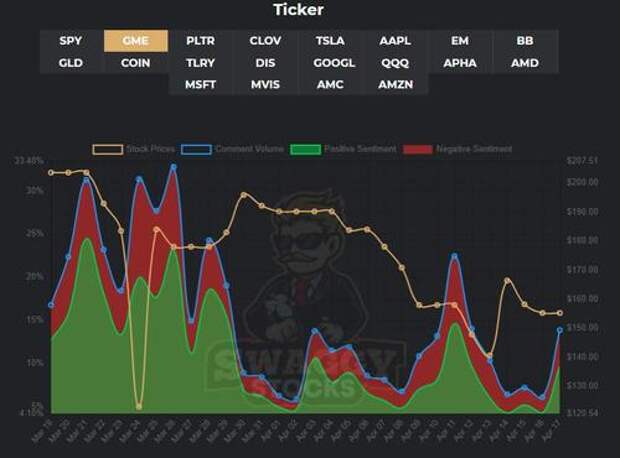

While shares of GameStop are up 721% YTD, though they are less than half of the peak level in January. However, now that Roaring Kitty has shown his Reddit peers that he is not only in it for the long run but doubling down, expect another squeeze on Monday as the latest generation of shorts which have entered the stock in recent weeks, is steamrolled, and as Reddit excitement in GME which had fizzled in recent weeks...

... explodes afresh.

And speaking of Chewy, we remind readers that the reason why the stock rose as high as the mid-$400s in February is not only the presence of Chewy founder Ryan Cohen, but that as the September Reddit write up noted, "if GME was trading at the same P/S multiple as $CHWY, the share price would be $420."

In short, GME may be about to double all over again.

Which begs another question: is the daytrading, gamma-squeeze mania that shook markets in late January, about to send GME - and the whole batch of most shorted names - soaring higher all over again?