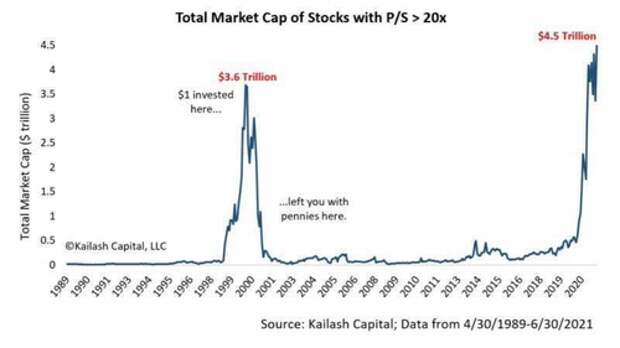

Kailash Capital had a great chart out recently showing the massive increase in the market capitalization of stocks with price-to-sales ratios greater than 20x.

“While we’ve seen an increase in the number of companies coming public via IPO’s / SPAC’s the number of investable companies hasn’t kept pace with the degree of inflows, resulting in re-ratings. Looking at the total market cap of stocks with P/S in excess of 20x we’ve surpassed the tech bubble high by nearly ~$1.0T.” – Kailash

If you don’t understand why a Price-To-Sales ratio greater than 20x is essential, let me remind you what Scott McNealy, then CEO of Sun Microsystems, told investors paying 10x Price-to-Sales for his company in a 1999 Bloomberg interview.

“At 10-times revenues, to give you a 10-year payback, I must pay you 100% of revenues for 10-straight years in dividends.

That assumes I can get that by my shareholders. It also assumes I have zero cost of goods sold, which is very hard for a computer company.

That assumes zero expenses, which is hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that expects you pay no taxes on your dividends, which is kind of illegal.

And that assumes with zero R&D for the next 10-years, I can maintain the current revenue run rate.

Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those underlying assumptions are?

You don’t need any transparency. You don’t need any footnotes.

What were you thinking?”

Ready for the S&P 500 to Snapback?

Michael Queenan (@mjqueenan) provides yet another reminder of the extreme deviation of the S&P 500 from its trend. Per his tweet:

“For anyone tracking, this is now the second-longest the $SPX has gone without touching the daily 200 EMA. April 1958 to June 1959 (289 bars) is the longest. We are currently up to 213 bars.”

Finally, we note that bonds appear unloved at the moment.

According to Bank of America, with $3.2 trillion of assets held by private clients, allocations to bonds are at an all-time low of 17.7%. At the same time, stock holdings are at an all-time high of 65.2%. Thus, assuming the data represents most individual accounts throughout the banking /brokerage system, which seems plausible, there is a lot of fodder for a bond rally at the expense of stock prices.