One day after we predicted that a short squeeze was coming for bonds as a record number of shorts had emerged in 10Y TSY futures...

And squeeze pic.twitter.com/E64lkrnU3X

— zerohedge (@zerohedge)

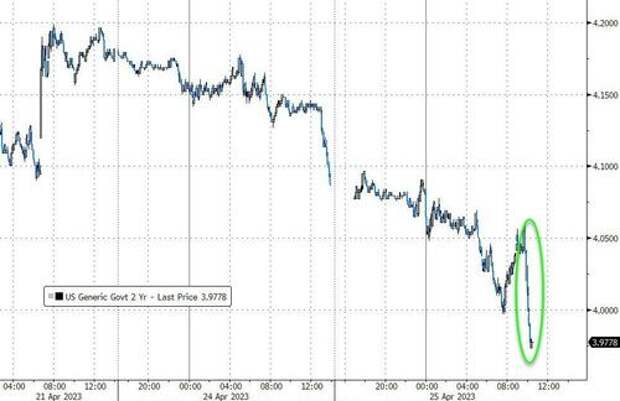

... yields indeed have slumped, with 10Ys dropping to session lows below 3.40%, down more than 10bps on the day. So with substantial demand for safe havens, and with the short-end of the curve also benefiting, it's hardly a surprise that today's 2Y auction was solid

Pricing at a high yield of 3.969%, the auction stopped 4.2bps higher than last month, and tailed the When Issued 3.966% by 0.3bps. This was expected in light of the sharp decline in yield ahead of the auction.

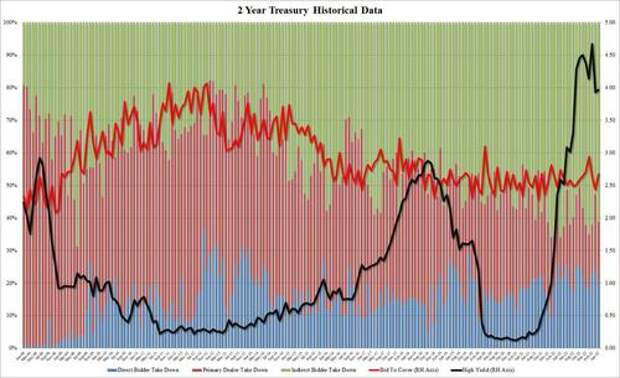

Other metrics were far more solid: the bid to cover came in at 2.68, well above last month's 2.44, and above the six-auction average of 2.66.

The internals were also solid, with Indirects taking down 61.2%, well above last month's 52.8%. And with Directs awarded 19.9%, slightly below the recent average of 22.0%, Dealers were left holding 18.9%.

Overall, this was a strong auction despite the modest tail, and as yields slide lower today, we just may see another substantial squeeze send the TSY complex spiking much higher by EOD.