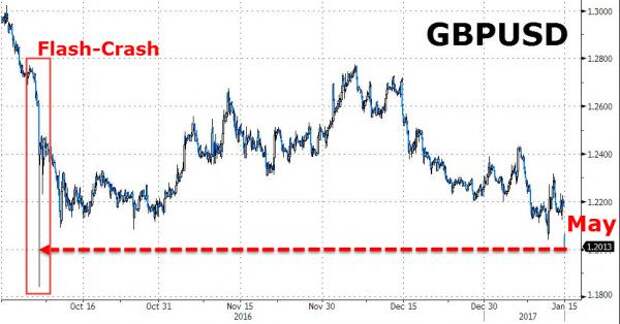

As cautioned earlier, following headlines about potential comments from UK PM Theresa May calling for a "clean and hard" Brexit in her Tuesday speech, cable has plunged to a 1.19 handle in very early (and illiquid) AsiaPac trading. This is the lowest level for sterling relative to the dollar since the October flash-crash.

It appears the New Zealand FX traders are active early, having pushed the pound as much as 1.6% to $1.1986 in Auckland on Monday, the lowest level since Oct. 7.

“The prospect of another speech from PM May is likely to see sterling yet again on a something of a roller-coaster,” Jeremy Stretch, head of Group-of-10 foreign-exchange strategy at Canadian Imperial Bank of Commerce, wrote in an e-mailed note before markets opened. “Fresh sterling lows versus the dollar seem almost inevitable.”

Meanwhile, in an ad hoc note from the DB FX team, the German banks sees much more downside: "in terms of market implications we see today's press reports as a material negative should they prove accurate and a catalyst for the rmarket beginning to price hard Brexit. As per our recent FX Blueprint publications, we see a deterioration in political rhetoric around Brexit as a key catalyst for further sterling weakness and see the large terms of trade shock from full exit from the Single Market consistent with GBP/USD at 1.06 or EUR/GBP close to parity respectively."

Incidentally, should cable tumble to a full "hard Brexit" level of Euro parity, we full anticipate that the FTSE100 will rise above 8,000 in no time.