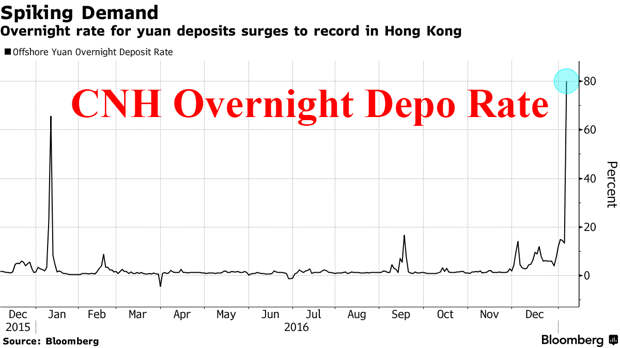

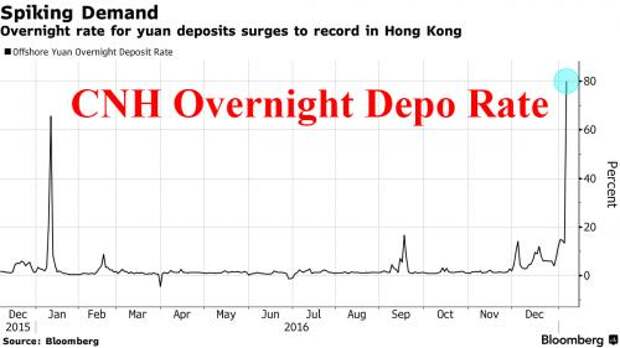

Last night we were amazed to report that with China starting its trading day, the overnight offshore yuan (CNH) deposit rate had exploded 31.5% points higher to 45%, in a move which while freezing interbank liquidity and unleashing havoc to short-term bank funding needs, had the more direct intention of crushing Yuan shorts, by making short holding costs soar through the roof and forcing a short squeeze.

As it turns out, that was just the beginning, because before the night was over, the overnight offshore Yuan deposit would hit a record 80%, while the USDCNH would tumble as low as 6.78, resulting in the biggest 2-day move higher in the offshore Yuan on record, or as Bloomberg reports, "the yuan gained 1% at 2:53 p.m. in Hong Kong, taking its two-day move to 2.3%, the most in data going back to 2010."

But the one chart everyone is talking about today is that of the overnight CNH deposit rate, which after touching 45% at the start of China trading day, surged to a record 80% just a few hours later...

... while the spread between the offshore and onshore exchange rates widened to the on record. Ultimately, the offshore yuan erased the day’s losses in a sudden move around 1:05 p.m as the premium over the onshore rate widened to 1.2%.

This follows after Chinese policymakers explicitly urged SOE banks to sell foreign currencies, and further "punish" short sellers.

The overnight deposit rate in the city surged to a record 80 percent, while the spread between the offshore and onshore exchange rates widened to the most since 2010. Bloomberg News earlier reported Chinese policy makers were encouraging state-owned enterprises to sell foreign currency.

As SocGen summarized the unprecedented indirect intervention by the PBOC, "investors are cutting bullish positions in the dollar after the report underscored China’s determination to support the yuan."

The overnight fireworks come, of course, after policymakers in Beijing recently unveiled a slew of new capital control measures to tighten control of the currency market, including placing higher scrutiny on citizens’ conversion quotas and stricter requirements for banks reporting cross-border transactions.

“Given the recent capital controls, the channels for domestic institutions and retails to bring out onshore cash to the offshore market have also been tightened,” said Becky Liu, a rates strategist in Hong Kong at Standard Chartered Plc. “There is a lack of supply of yuan liquidity.”

Meanwhile, the liquidity drain which we have followed every day this week continued, and is set to accelerate further as tomorrow forward points surged to a record. In other signs of yuan scarcity, HSBC Holdings raised its three-month yuan deposit rate to 2.85 percent from 1.8 percent, according to the Oriental Daily, while the cost of borrowing yuan overnight in Hong Kong surged by 21.4 percentage points, Bloomberg reported. That’s the most since January 2016, when the authorities choked yuan supply to burn speculators betting on declines.

Paradoxically, the measures have only heightened skepticism among currency watchers: “We know the capital controls aren’t working because that’s why they’re having to raise the overnight deposit rate so aggressively by the PBOC, which is still basically the guiding hand in the offshore yuan market,” said Michael Every, head of financial markets research at Rabobank Group in Hong Kong. “It’s an incredibly aggressive tactic.”

High short-term funding costs, which will continue to trend higher, could dissuade significant short yuan positions from being added in the near term, Societe Generale strategists led by Jason Daw wrote in a note Thursday.

The good news is that, if only briefly, the rebounding Yuan would alleviate capital outflow pressure on Chinese authorities, who are battling to curtail capital flowing offshore after an annual $50,000 quota for citizens to buy foreign exchange reset on Jan. 1 and the imminent inauguration of U.S. President-elect Donald Trump lifts the dollar. Investors have been watching for the yuan to break the psychologically key level of 7 against the greenback for the first time since 2008.

However, make no mistake, this is capital control war to prevent the Yuan from being dragged lower as the dollar surges, a war which overnight spilled over into other Asian currencies, most of which jumped in sympathy with the Yuan.

“The weaker dollar overnight should help push the yuan further away from the 7 level for now, aiding the Chinese authorities’ recent efforts to stabilize the currency,” said Christy Tan, head of markets strategy in Hong Kong at National Australia Bank Ltd. “We expect the authorities to maintain an elevated currency management mode in the run-up to Donald Trump’s inauguration on Jan. 20, and until after the Lunar New Year break from Jan. 27 to Feb. 2.”

Ultimately, the offshore yuan’s strength will be short-lived because the Hong Kong Monetary Authority may add supply of the currency to lower funding costs, and the dollar could rally, said Andy Ji, a Singapore-based currency strategist at Commonwealth Bank of Australia... but not before enough shorts have been carted out feet first. Even so, the long-term direction of the Yuan is clear: the onshore exchange rate will decline 3.6 percent to 7.15 per dollar by the end of this year, according to the median estimate in a Bloomberg survey.

"Fundamental reasons that are driving depreciation, such as capital outflows and concerns on Trump’s China policies, haven’t changed," said Qi Gao, a Singapore-based foreign-exchange strategist at Scotiabank, quoted by Bloomberg.